Overview

Most workers in Australia can choose which fund will receive their employer’s super contributions, but without help they have no reliable means of comparing one fund with another. That is the purpose of our fund ratings. By applying our knowledge and experience of funds, we can compare them in a way that is both fair and rigorous.

The result is a set of ratings that encapsulate our view about the quality of each fund we rate. We express those ratings in terms of Apples, reflecting our ‘apples with apples’ approach. Funds earn a rating ranging from 5 Apples, our highest grade, to 1 Apple, our lowest.

| Rating | | Definition |

| | Highest quality fund |

| | High quality fund |

| | Sound quality fund |

| | Low quality fund |

| | Lowest quality fund |

Our ratings are based on information that is either publicly available or is provided directly to us by the funds themselves. Where necessary, we modify that information to ensure fair comparisons. We give each fund the opportunity to review the information we use for its accuracy.

Main Criteria

When we rate super funds, we apply a methodology that was first developed in 1997 and has been continuously refined ever since. We focus on six main criteria: organisation, investments, fees, insurance, administration and member services.

We determine a score for each of the main criteria and then weight these to provide an overall rating for the fund.

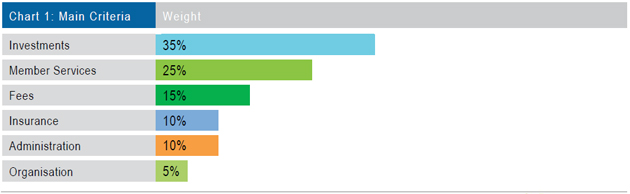

Chart 1 shows the main criteria we use and the weights we assign to them.

In the following sections, we look at each of the main criteria in turn, starting with the most important, and explain the sub-criteria owe assess for each of them.

Investments

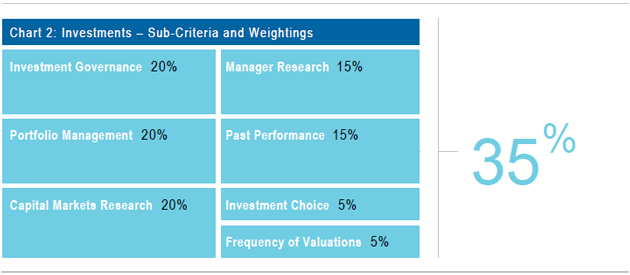

Investments are obviously important and account for 35% of our overall rating. When we rate a fund’s investments, we do not focus on past returns. Rather, we focus on assessing the quality of the fund’s investment governance, its in-house investment team, its external asset consultant (particularly for research), and the structure of its investment portfolios. If it does these things well, it is likely to have strong, long-term performance.

Most funds offer a range of investment options to choose from, but we concentrate our research mostly on the multi-manager options because that is where most members are invested.

Chart 2 shows what we take into account. It is worth noting that past performance only accounts for 15% of the total score for investments (which equates to 5.25% of our overall fund evaluation).

Member Services

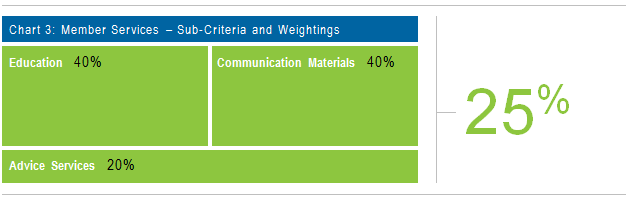

While investments carry the highest weighting in our ratings process, we believe member services are also vitally important. For that reason, they account for 25% of our overall weighting.

The best funds offer services that help their members to understand the purpose of super (which is to accumulate a 'nest egg' that will provide them with a comfortable income in retirement) how they are tracking to achieve their goals, and what they can do to ensure they meet their goals..

The main aspects that we focus on are education (retirement calculator, public website and secure website), communication materials (member statement and newsletters) and financial advice services.

Chart 3 shows those sub-criteria and the weightings we assign to them.

Fees

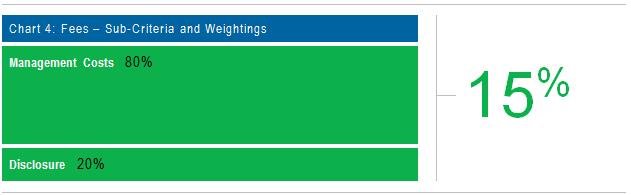

The fees that a member pays – either directly from their account or indirectly through their investments – have a bearing on how much money they end up with in retirement. However, a low fee fund is not necessarily the best. A fund may be cheap because its investments use a lot of passive management, or it may cut costs by providing little in the way of member services.

When we assess a fund on fees, we look not only at the fees and costs a member pays, directly or indirectly, but also on how clearly and completely the fund discloses those fees and costs, as shown in

Chart 4.

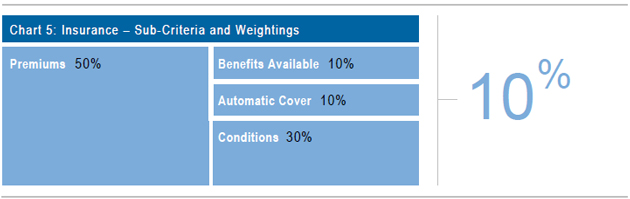

Insurance

Insurance is an important benefit, but it is also a cost that a member pays so they want to be comfortable that it represents good value. The best funds provide cover that is affordable, flexible, relevant to the demographics of their membership, and requires the minimum of paperwork and medical evidence.

The aspects we look at are the premiums, the conditions that apply before benefits are paid, the amount of cover available without medical evidence and the range and relevance of the benefits provided. These are shown in

Chart 5.

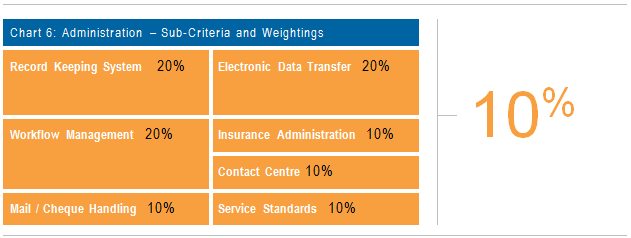

Administration

For a fund to deliver high quality services to its members and their employers, it needs to have efficient administration. There is a range of factors, including systems and service standards that we look at when we assess a fund's administration. These are shown in

Chart 6.

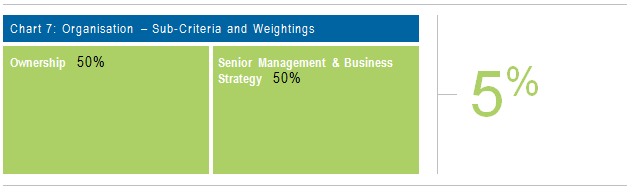

Organisation

Australian super funds are highly regulated and they are not geared, so the chance of failure is quite remote. Nevertheless, it is important to know that the organisation behind the fund has the capacity to sustain and improve it now and into the future.

When we assess a fund on organisation, we look at who owns or controls it, the strength of its management team and its strategy for the future, as shown in

Chart 7.

Disclaimer

© Chant West Pty Limited (ABN 75 077 595 316) 1997 - 2016. You may only use this document for your own personal, non-commercial use. This document may not be copied, reproduced, scanned or embodied in any other document or distributed to another party unless you have obtained the prior written consent of Chant West to do so.

The information above is based on data supplied by third parties. While such data is believed to be accurate, Chant West does not accept responsibility for any inaccuracy in such data. Past performance is not a reliable indicator of future performance. The products, reports and ratings do not contain all of the information that is required in order to evaluate the nominated service providers, and you are responsible for obtaining such further information.

This information does not constitute financial product advice. However, to the extent that this document may be considered to be general financial product advice then you acknowledge that you have been provided with a

Financial Services Guide and Chant West warns that: (a) Chant West has not considered any individual person’s objectives, financial situation or particular needs; (b) individuals need to consider whether the advice is appropriate in light of their goals, objectives and current situation; and (c) individuals should obtain a Product Disclosure Statement from the relevant fund provider before making any decision about whether to acquire a financial product from that fund provider.